Introduction

The financial services industry has always been a pioneer in adopting emerging technologies — from ATMs in the 1970s to mobile banking in the 2000s. In 2025, artificial intelligence (AI) continues to redefine FinTech software development, driving efficiency, security, and customer experience to new heights.

AI is no longer just a back-end tool for fraud detection; it has become a core enabler of innovation across payment systems, investment platforms, digital banks, and insurance apps. The integration of machine learning (ML), natural language processing (NLP), and generative AI into FinTech is transforming how money moves, how risks are managed, and how customers interact with financial products.

This guide explores how AI is shaping FinTech software development in 2025 — the key trends, applications, and opportunities developers and financial institutions must embrace to stay competitive.

Why AI Matters in FinTech

- Data-Driven Decisions

Financial services generate massive amounts of transactional, behavioral, and market data. AI helps analyze this data at scale to provide actionable insights. - Fraud Prevention

AI models spot anomalies in real time, reducing financial crime losses that amount to billions annually. - Personalized Services

Customers expect tailored financial advice and product recommendations. AI enables hyper-personalization at scale. - Automation & Efficiency

From underwriting to loan processing, AI automates tasks that once required entire teams of analysts. - Competitive Differentiation

In a crowded FinTech landscape, AI-driven features like robo-advisors, instant lending, and AI chatbots create unique value propositions.

Key AI Trends in FinTech Software Development (2025)

1. Generative AI for Financial Services

- What’s new in 2025: GenAI models trained specifically on financial datasets are powering personalized investment advice, regulatory report automation, and natural-language financial queries.

- Example: Customers asking, “What’s the best way to save $10,000 this year?” and receiving tailored, compliance-approved advice.

2. Explainable AI (XAI)

- Transparency is crucial in finance. Black-box models are being replaced with explainable ones, enabling users, regulators, and developers to understand how AI makes decisions.

- Example: A loan applicant not only receives an approval/denial but also sees the key factors influencing the decision.

3. AI-Powered Security & Fraud Detection

- In 2025, AI models analyze behavioral biometrics (typing speed, swipe patterns, geolocation) alongside transaction data to identify fraud in milliseconds.

- Real-time adaptive security ensures fewer false positives than traditional rule-based systems.

4. Embedded AI in FinTech APIs

- APIs for payment gateways, KYC (Know Your Customer), and AML (Anti-Money Laundering) now come with AI baked in.

- Developers can integrate fraud detection, identity verification, and compliance checks with minimal custom coding.

5. Cloud-Native AI Development

- Cloud providers like AWS, Azure, and GCP offer specialized AI toolkits for FinTech.

- Multi-cloud FinTech architectures ensure resilience, compliance, and global reach.

6. Human-AI Collaboration

- Instead of replacing financial advisors, AI in 2025 acts as a co-pilot — providing data-driven recommendations while humans retain final decision-making authority.

Major Applications of AI in FinTech Software

1. Fraud Detection & Risk Management

- Traditional Problem: Fraud detection relied on static rules, leading to high false positives.

- AI Solution: Machine learning algorithms continuously learn from transaction patterns to detect fraud in real time.

- Impact in 2025: AI-driven fraud detection reduces fraud losses by up to 40% for major payment platforms.

2. Credit Scoring & Loan Underwriting

- AI analyzes not only credit history but also alternative data such as utility payments, mobile usage, and online behavior.

- Benefit: Expands credit access to underbanked populations who may lack traditional credit histories.

- Developers are integrating AI scoring engines directly into lending platforms for instant approvals.

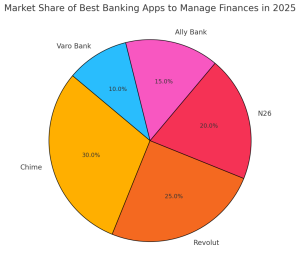

3. Personalized Banking & Wealth Management

- AI-powered robo-advisors offer tailored investment portfolios based on real-time market analysis and customer goals.

- NLP enables natural conversations in banking apps, where customers ask questions like, “How much can I safely invest this month?”

4. Algorithmic Trading

- Advanced ML models in 2025 can process global market signals, social media sentiment, and macroeconomic data within milliseconds.

- FinTech trading apps now embed AI-powered trading bots accessible even to retail investors.

5. Regulatory Compliance (RegTech)

- Compliance reporting is often a bottleneck.

- AI automates report generation, transaction monitoring, and AML checks.

- In 2025, RegTech + AI integration is mandatory for many jurisdictions to reduce financial crime.

6. Customer Support & Chatbots

- AI-powered virtual assistants handle 80–90% of support queries in FinTech apps.

- Generative AI enables human-like responses, while context-aware chatbots escalate complex queries to human agents.

7. Insurance (InsurTech)

- AI accelerates claims processing through image recognition and NLP (e.g., scanning accident reports).

- Risk assessment models analyze real-time data from IoT devices, wearables, and telematics.

8. Payments & Transactions

- AI streamlines cross-border payments by predicting optimal currency conversion times and reducing FX costs.

- Real-time AI scoring ensures safe peer-to-peer (P2P) transactions in digital wallets.

Advanced Innovations in AI for FinTech (2025 and Beyond)

The first wave of AI in FinTech focused on automation (fraud checks, chatbots). The second wave, now peaking in 2025, emphasizes intelligence, adaptability, and proactivity. Here are cutting-edge innovations shaping the landscape:

1. Hyper-Personalized Financial Ecosystems

- AI aggregates data across multiple accounts, apps, and spending categories.

- Instead of generic dashboards, users receive personal financial blueprints: savings goals, investment options, tax optimization.

- Example: A digital bank automatically adjusts savings account interest tiers based on projected cash flow.

2. Synthetic Data for Financial Modeling

- Regulatory restrictions often limit access to customer data.

- In 2025, AI generates synthetic datasets that mirror real-world behavior, allowing safer model training without breaching privacy.

- This reduces compliance risk while enabling powerful innovation.

3. Quantum-Aware AI Models

- With the growth of quantum computing research, some FinTech firms are experimenting with AI models optimized for quantum-assisted computations.

- Application: Faster risk analysis, real-time market simulations, and advanced cryptography.

4. Generative AI for Compliance

- Compliance teams use GenAI to draft, review, and validate reports against ever-changing regulatory frameworks.

- Natural language compliance bots guide developers: “This new lending feature must adhere to X regulation in these countries.”

5. AI-Powered ESG (Environmental, Social, Governance) Investing

- ESG compliance is a rising demand among investors.

- AI scans annual reports, social media sentiment, and government filings to generate real-time ESG ratings for companies.

- FinTech apps now let users filter investment portfolios by ESG alignment with AI-driven verification.

6. Federated Learning for Data Privacy

- Instead of centralizing sensitive financial data, federated learning enables AI models to train across distributed data sources without moving data.

- Example: Multiple banks collaborate on a fraud-detection model without sharing raw customer records.

Challenges of AI in FinTech (2025)

Despite its promise, AI adoption comes with hurdles that both developers and financial institutions must address.

1. Regulatory Complexity

- Different jurisdictions enforce different AI rules.

- Example: The EU’s AI Act mandates risk classification, while the U.S. focuses on transparency and bias audits.

- Developers must design compliance-first architectures.

2. Data Privacy & Security

- Financial data is highly sensitive. Breaches not only cause monetary loss but also destroy trust.

- Stricter data localization laws in 2025 mean FinTech firms must design AI systems with region-specific compliance.

3. Algorithmic Bias

- Biased AI models can lead to discriminatory outcomes in lending or insurance.

- Regulators now require explainability reports and fairness audits.

4. Integration with Legacy Systems

- Many banks still run on COBOL-based mainframes.

- Integrating AI APIs into these legacy systems requires middleware and containerized solutions.

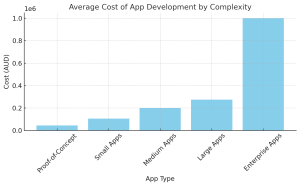

5. Cost of Scaling AI

- AI models, especially GenAI, are computationally expensive.

- Cloud costs can spiral without optimization (model compression, caching, API throttling).

Case Studies of AI in FinTech (2025)

Case Study 1: Neobank with AI-First Customer Support

- Problem: Growing customer base overwhelmed traditional support teams.

- Solution: Integrated an AI-powered, multilingual chatbot with generative capabilities.

- Result: 85% of customer queries resolved without human intervention, response times dropped from 15 minutes to under 30 seconds.

Case Study 2: AI in Micro-Lending Platforms

- Problem: Traditional credit scores excluded rural populations in emerging markets.

- Solution: AI models analyzed alternative data (mobile usage, digital payments, even social interactions).

- Result: Millions of new borrowers gained access to microloans, repayment rates improved by 25%.

Case Study 3: Hedge Fund Using AI Trading Agents

- Problem: Manual trading strategies couldn’t keep pace with real-time market fluctuations.

- Solution: Deployed AI agents capable of analyzing 50+ global data streams simultaneously.

- Result: 12% higher ROI compared to traditional strategies.

Case Study 4: Insurance Startup with AI-Driven Claims

- Problem: Long delays in claims processing.

- Solution: AI vision models assessed car damage images in seconds, while NLP extracted claim details from customer messages.

- Result: Claim approvals shortened from weeks to hours, boosting customer satisfaction.

Key Takeaways for FinTech Developers in 2025

- Adopt AI-First APIs

Use embedded AI features from providers (fraud detection, AML checks) rather than reinventing the wheel. - Prioritize Explainability

Build transparent models with explainable outputs. Regulators and customers demand it. - Leverage Cloud & Edge Together

Heavy AI workloads run in the cloud; real-time inference can run at the edge (mobile apps, smart cards). - Optimize for Cost Efficiency

Use model compression, caching, and serverless infrastructure to keep AI sustainable. - Think Global, Act Local

Tailor AI features to comply with local regulations while maintaining global product scalability. - Stay Human-Centric

AI should enhance human decision-making, not fully replace it — especially in finance where trust is paramount.

Conclusion

AI in FinTech software development in 2025 is not about hype — it’s about practical transformation. From hyper-personalized financial experiences to fraud detection, compliance automation, and AI trading, artificial intelligence is redefining how money moves and how financial institutions serve customers.

But with this transformation comes responsibility. Developers must balance innovation with compliance, fairness, and trust. Those who succeed will power the next generation of financial services — ones that are more secure, inclusive, and intelligent than ever before.

FAQs

1. What’s the most common use of AI in FinTech in 2025?

Fraud detection and risk management remain top priorities, but customer personalization and compliance automation are rapidly rising.

2. Can small FinTech startups afford AI integration?

Yes. Cloud-based AI APIs (OpenAI, AWS AI, Google Vertex) let startups pay-as-they-go without massive upfront infrastructure.

3. How is regulation affecting AI in finance?

The EU’s AI Act and similar frameworks worldwide require explainability, bias checks, and stricter compliance. Developers must design regulation-ready AI.

4. Will AI replace financial advisors?

No. AI acts as a co-pilot — handling data analysis and recommendations while humans provide trust, empathy, and strategic oversight.

5. How do FinTechs handle customer trust with AI?

By ensuring transparency, respecting data privacy, and providing explainable results. Trust is as important as technology.

6. What’s next after 2025 in AI and FinTech?

Expect growth in quantum-enhanced AI for risk modeling, real-time ESG investment tools, and federated AI systems for data privacy.